The most widely recognized financial software in the English-speaking world is QuickBooks, primarily due to its comprehensive features, user-friendly interface, and extensive support network.

I. OVERVIEW OF QUICKBOOKS

QuickBooks is a highly popular financial software developed by Intuit. It has carved a niche for itself among small to medium-sized businesses due to its extensive suite of features that simplify financial management. Here are some key aspects:

- User-Friendly Interface: QuickBooks is designed with a straightforward, intuitive interface that makes it accessible even to users with limited accounting knowledge.

- Comprehensive Features: It offers a range of functionalities including invoicing, expense tracking, payroll processing, and financial reporting.

- Cloud-Based and Desktop Versions: QuickBooks provides both cloud-based and desktop versions, catering to different user needs and preferences.

- Extensive Support: QuickBooks has a vast support network, including customer service, community forums, and third-party consultants.

II. DETAILED FEATURES OF QUICKBOOKS

QuickBooks stands out in the financial software market due to its robust set of features, which include:

Invoicing

- Customizable Templates: Allows businesses to create professional invoices with their branding.

- Automated Reminders: Sends reminders for due or overdue invoices to ensure timely payments.

- Multiple Payment Options: Supports various payment methods including credit cards and bank transfers.

Expense Tracking

- Receipt Capture: Users can snap photos of receipts and attach them to expenses for easy tracking.

- Categorization: Expenses can be categorized for better financial management and tax preparation.

- Integration with Bank Accounts: Automatically imports transactions from linked bank accounts.

Payroll Processing

- Automated Calculations: Calculates payroll taxes and deductions automatically.

- Direct Deposit: Facilitates direct deposit for employees, ensuring timely payments.

- Compliance: Keeps up with the latest payroll tax laws to ensure compliance.

Financial Reporting

- Custom Reports: Generates various financial reports such as profit and loss statements, balance sheets, and cash flow statements.

- Insights and Analytics: Provides insights and analytics to help businesses make informed financial decisions.

- Real-Time Data: Access to real-time financial data for accurate reporting and forecasting.

III. COMPARISON WITH OTHER FINANCIAL SOFTWARE

When comparing QuickBooks with other financial software, several factors stand out:

| Feature/Software | QuickBooks | Xero | FreshBooks |

|---|---|---|---|

| User Interface | Intuitive | User-friendly | Simple |

| Invoicing | Comprehensive | Good | Excellent |

| Expense Tracking | Robust | Strong | Moderate |

| Payroll | Extensive | Available | Limited |

| Financial Reports | Customizable | Detailed | Basic |

| Support | Extensive | Good | Adequate |

User Interface

QuickBooks is known for its intuitive and easy-to-navigate interface, making it accessible for users with varying levels of accounting expertise.

Invoicing

While all three options provide invoicing capabilities, QuickBooks and FreshBooks offer more customization and automation features compared to Xero.

Expense Tracking

QuickBooks excels in expense tracking with features like receipt capture and bank integration, whereas Xero also offers robust tracking but FreshBooks is somewhat limited in this area.

Payroll

QuickBooks provides extensive payroll processing features, including automated calculations and direct deposits, which are more comprehensive than the offerings from Xero and FreshBooks.

Financial Reports

QuickBooks allows for highly customizable financial reports, providing detailed insights and analytics, which can be more in-depth compared to the basic reporting features of FreshBooks.

Support

QuickBooks boasts an extensive support network including customer service, community forums, and third-party consultants, providing more comprehensive support than Xero and FreshBooks.

IV. USE CASES AND SUCCESS STORIES

Small Businesses

QuickBooks is extensively used by small businesses due to its affordability and comprehensive feature set. For instance, a small retail business can use QuickBooks to manage their inventory, track sales, and generate financial reports to understand their profitability.

Freelancers and Contractors

Freelancers and contractors benefit from QuickBooks' invoicing and expense tracking features. For example, a freelance graphic designer can easily invoice clients, track expenses related to projects, and manage their finances efficiently.

Non-Profits

Non-profit organizations use QuickBooks to manage their funding and expenses. A non-profit can track donations, generate reports for grant applications, and ensure compliance with financial regulations.

Case Study: ABC Construction

ABC Construction, a medium-sized construction company, implemented QuickBooks to streamline their financial management. They used QuickBooks for job costing, payroll processing, and financial reporting. As a result, they improved their profitability tracking, ensured timely payroll, and gained valuable insights into their financial performance, leading to better decision-making and growth.

V. FUTURE TRENDS IN FINANCIAL SOFTWARE

Artificial Intelligence and Automation

Financial software is increasingly integrating AI and automation to streamline processes. QuickBooks is already incorporating AI to automate repetitive tasks such as data entry and expense categorization, improving efficiency and accuracy.

Cloud Computing

The shift towards cloud-based solutions continues to grow, offering businesses flexibility and real-time access to financial data. QuickBooks Online is a prime example, providing users with the ability to manage their finances from anywhere, at any time.

Integration with Other Tools

Financial software is increasingly integrating with other business tools such as CRM systems, project management software, and e-commerce platforms. QuickBooks offers numerous integrations, allowing businesses to create a seamless workflow across different systems.

Enhanced Data Security

As data security becomes a growing concern, financial software providers are enhancing their security measures. QuickBooks employs advanced encryption and multi-factor authentication to protect user data, ensuring that sensitive financial information remains secure.

Mobile Accessibility

With the rise of mobile technology, financial software is becoming more accessible on mobile devices. QuickBooks offers a mobile app that allows users to manage their finances on the go, providing flexibility and convenience.

CONCLUSION AND ACTION STEPS

QuickBooks stands out as a comprehensive and user-friendly financial software solution, particularly well-suited for small to medium-sized businesses. Its extensive features, ease of use, and robust support network make it a top choice for managing financial tasks effectively.

Action Steps:

- Evaluate Your Needs: Assess your business's financial management needs to determine if QuickBooks aligns with your requirements.

- Explore QuickBooks Features: Take advantage of QuickBooks' free trial to explore its features and see how they can benefit your business.

- Seek Support: Utilize QuickBooks' support resources, including customer service and community forums, to get the most out of the software.

- Stay Updated: Keep an eye on future trends and updates in financial software to ensure your business continues to benefit from the latest advancements.

By following these steps, businesses can effectively leverage QuickBooks to streamline their financial management processes, enhance decision-making, and drive growth.

相关问答FAQs:

在当今数字化时代,许多企业和个人都在寻找高效的财务软件来管理他们的财务事务。以下是一些广泛使用的英文财务软件,它们各自具有独特的功能和优势。

1. QuickBooks

QuickBooks 是一款非常流行的财务管理软件,特别适合小型企业。它提供了多种功能,包括账务管理、发票生成、费用追踪和财务报告。用户可以通过其直观的界面轻松操作,甚至可以通过移动设备管理财务数据。QuickBooks 还允许用户与会计师共享数据,简化了财务审计过程。

2. Xero

Xero 是一款基于云计算的财务软件,适合各类企业。它的界面友好,功能全面,包括银行对账、发票管理和在线支付等。Xero 还支持多种货币交易,使其适合国际业务。此外,Xero 提供了丰富的应用集成,可以与其他业务工具无缝连接,提升工作效率。

3. FreshBooks

FreshBooks 专注于服务型企业,提供简化的账务管理和发票功能。它允许用户轻松创建和发送专业的发票,并追踪客户的付款状态。FreshBooks 还支持时间跟踪和项目管理功能,适合自由职业者和小型团队。其用户友好的界面使得新用户能够快速上手。

4. Wave

Wave 是一款免费的财务软件,适合初创企业和个人使用。尽管是免费的,Wave 提供了强大的功能,包括账务管理、发票生成和收支报告。用户可以通过其简单的界面进行操作,轻松追踪财务状况。Wave 还支持信用卡支付和银行对账功能。

5. Zoho Books

Zoho Books 是 Zoho 套件中的一部分,专为中小型企业设计。它提供全面的财务管理功能,包括费用管理、发票生成和项目管理。Zoho Books 的特点在于其强大的自动化功能,用户可以设置定期发票和自动提醒,减少手动操作的需要。

6. Sage Intacct

Sage Intacct 是一款高级财务管理软件,适合中大型企业。它提供了全面的财务管理功能,包括多公司和多币种管理。Sage Intacct 的强大之处在于其财务报告功能,用户可以生成各种定制报告,帮助企业做出更明智的财务决策。

7. Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central 是一款全面的企业资源规划(ERP)解决方案,包含财务管理模块。它适合中型企业,提供财务报告、预算管理和账务处理等功能。通过与其他 Microsoft 应用的集成,用户可以在一个平台上管理业务的各个方面。

8. NetSuite

NetSuite 是一款基于云的企业管理软件,提供财务、ERP 和 CRM 功能。它适合快速增长的企业,支持多种行业。NetSuite 的财务模块提供实时报告和分析功能,帮助企业更好地理解其财务状况并做出战略决策。

9. Kashoo

Kashoo 是一款专为小型企业和自由职业者设计的在线财务管理软件。它提供简单的账务管理和发票功能,用户可以通过其直观的界面轻松跟踪收入和支出。Kashoo 还支持多种支付方式,方便用户管理客户付款。

10. Tally

Tally 是一款在印度及其他地区广泛使用的财务管理软件。它适合各类企业,提供全面的财务管理功能,包括库存管理、报表生成和税务计算。Tally 的强大之处在于其灵活性和可定制性,用户可以根据具体需求调整功能。

总结

选择合适的财务软件对于企业的财务健康至关重要。不同的软件提供不同的功能和适用场景,企业应根据自身的需求和规模进行选择。无论是简单的账务管理还是复杂的财务分析,以上提到的软件都能提供有效的解决方案。希望这些信息能帮助您找到最适合的财务软件,提升财务管理的效率和准确性。

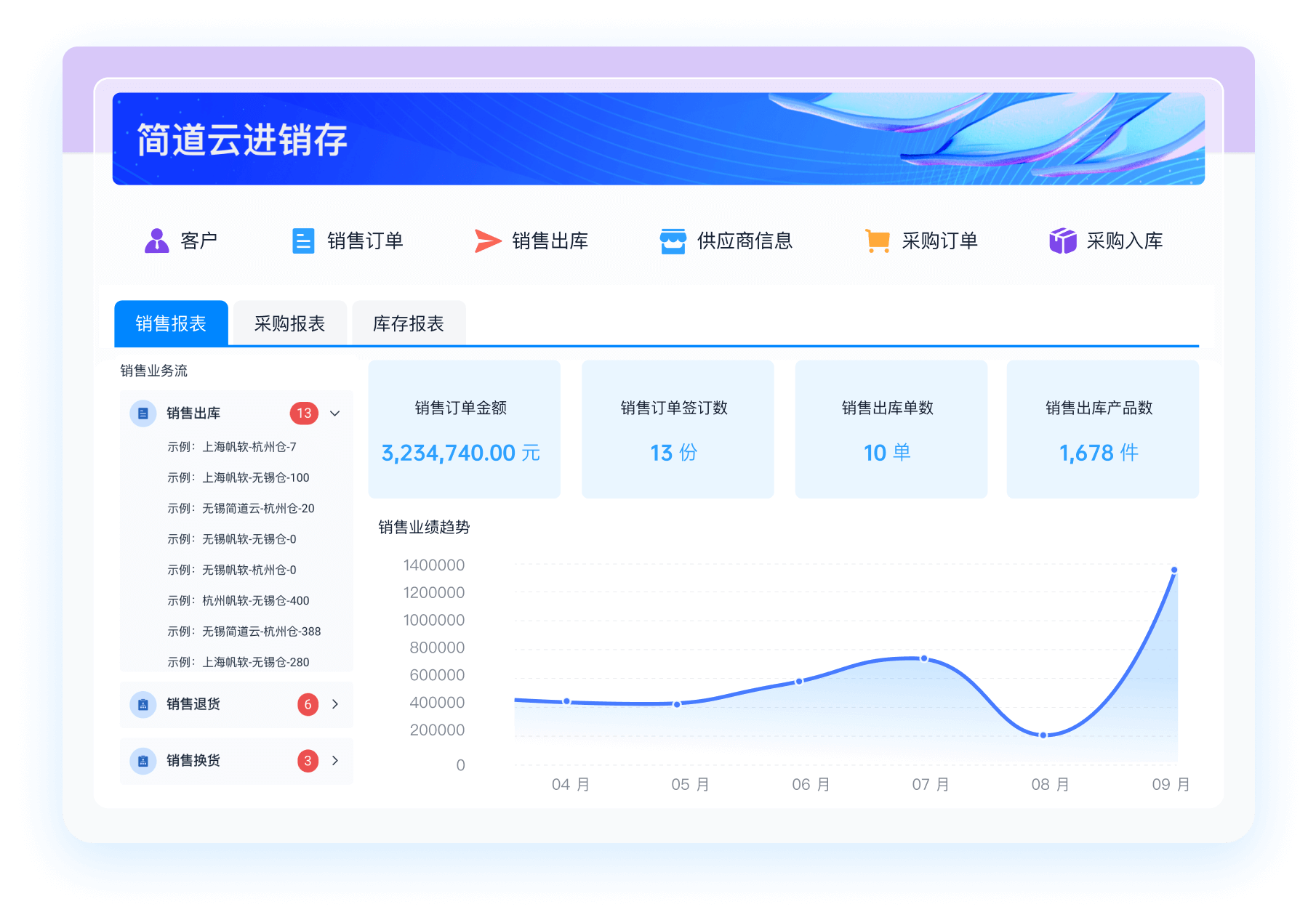

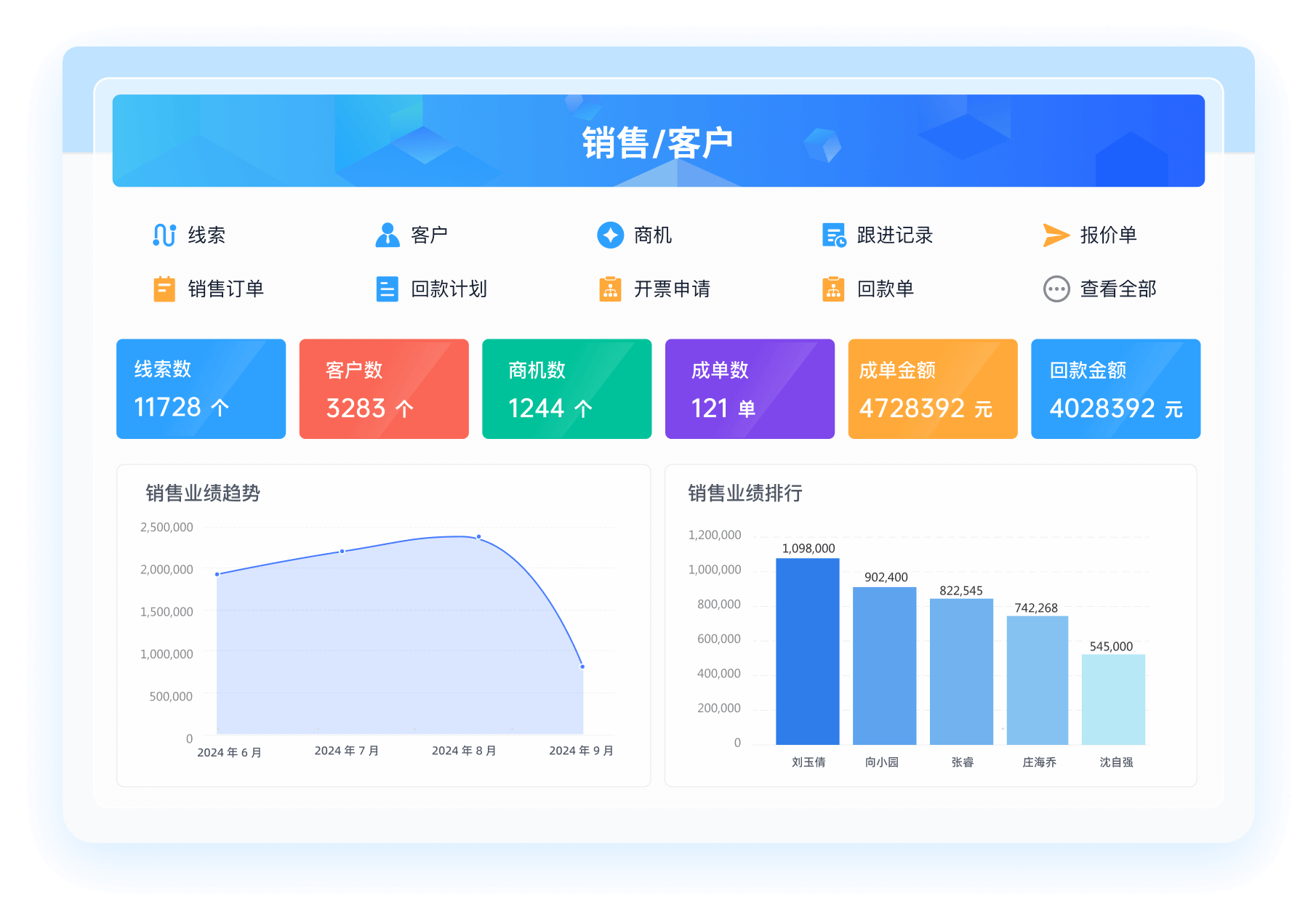

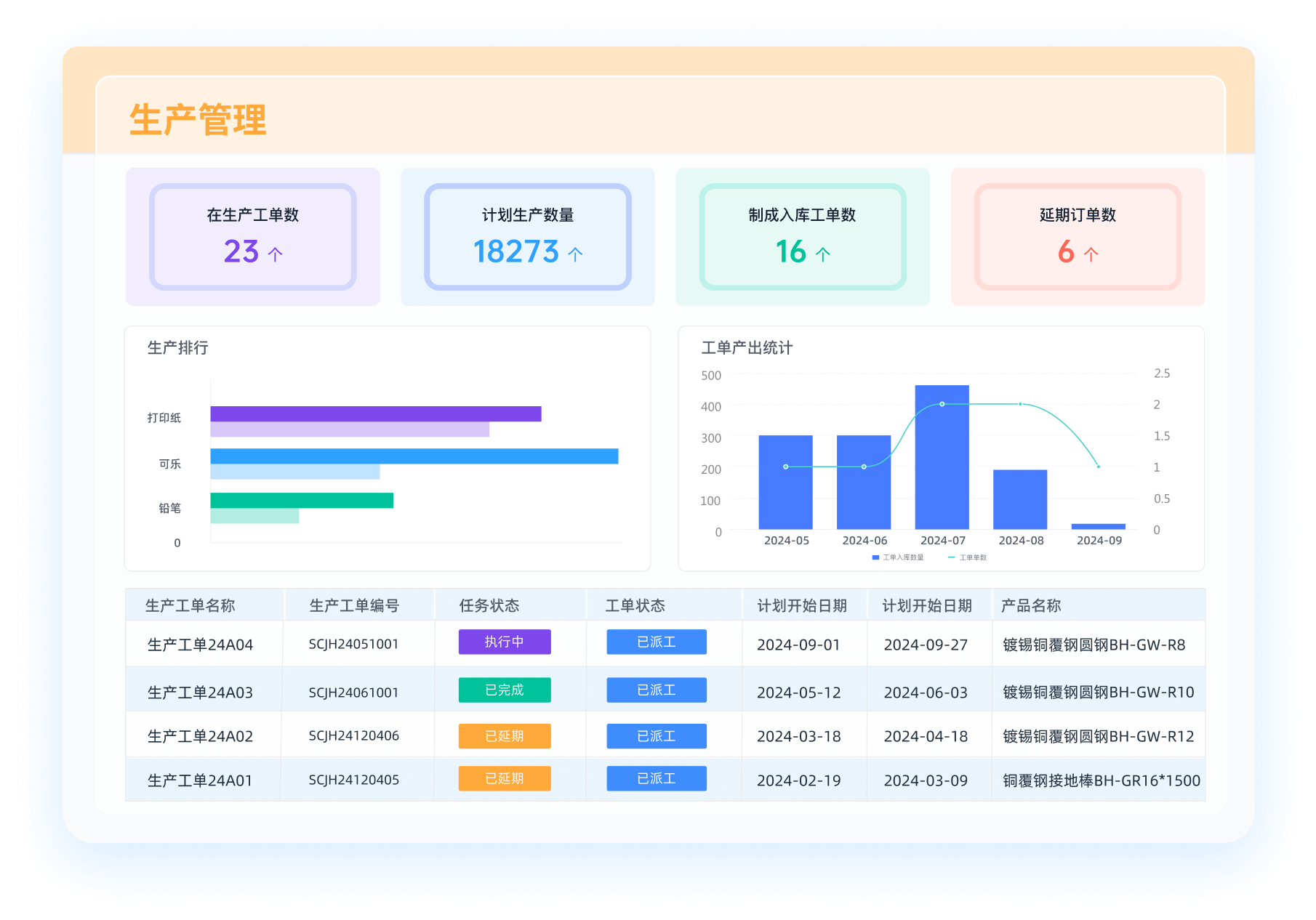

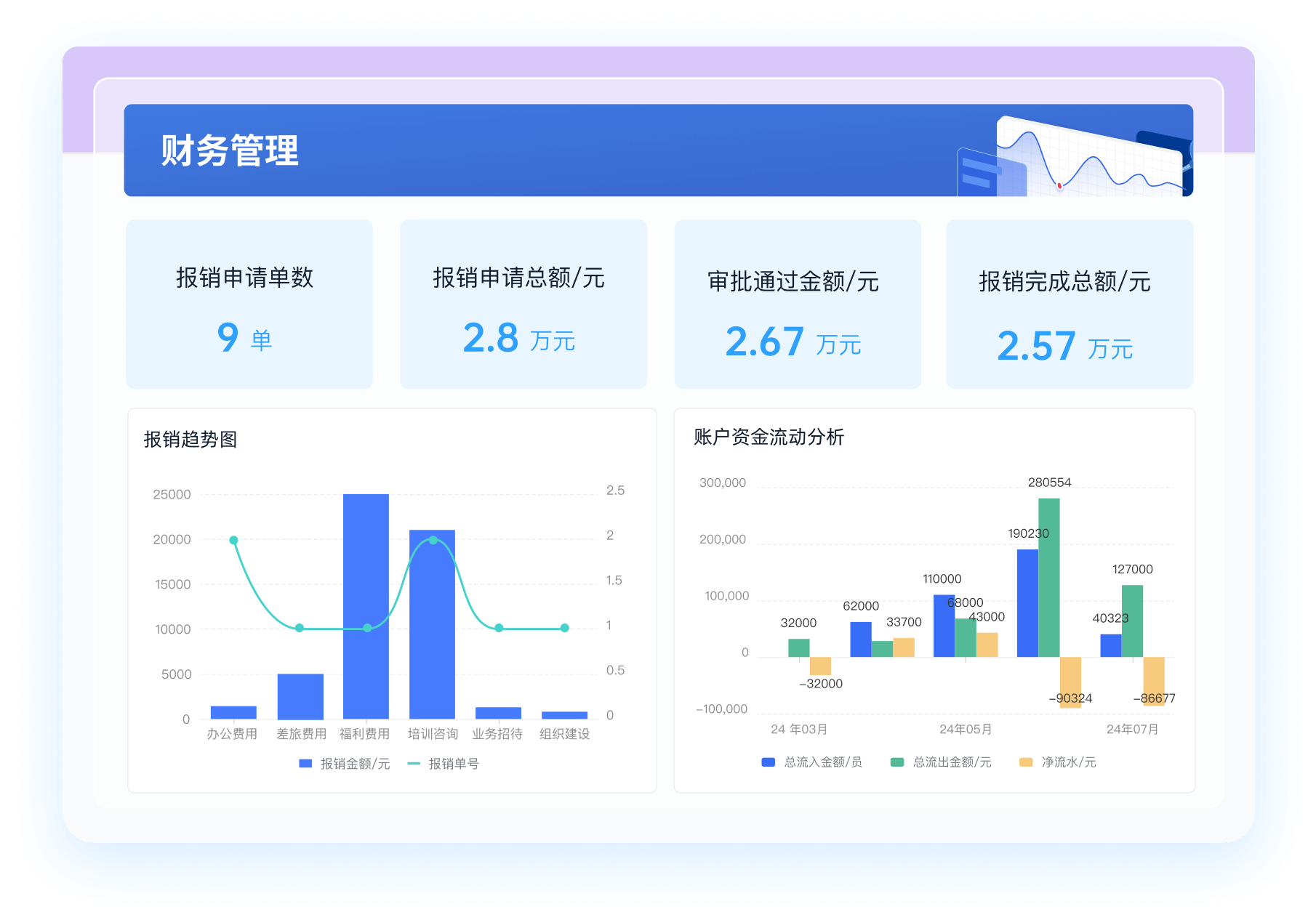

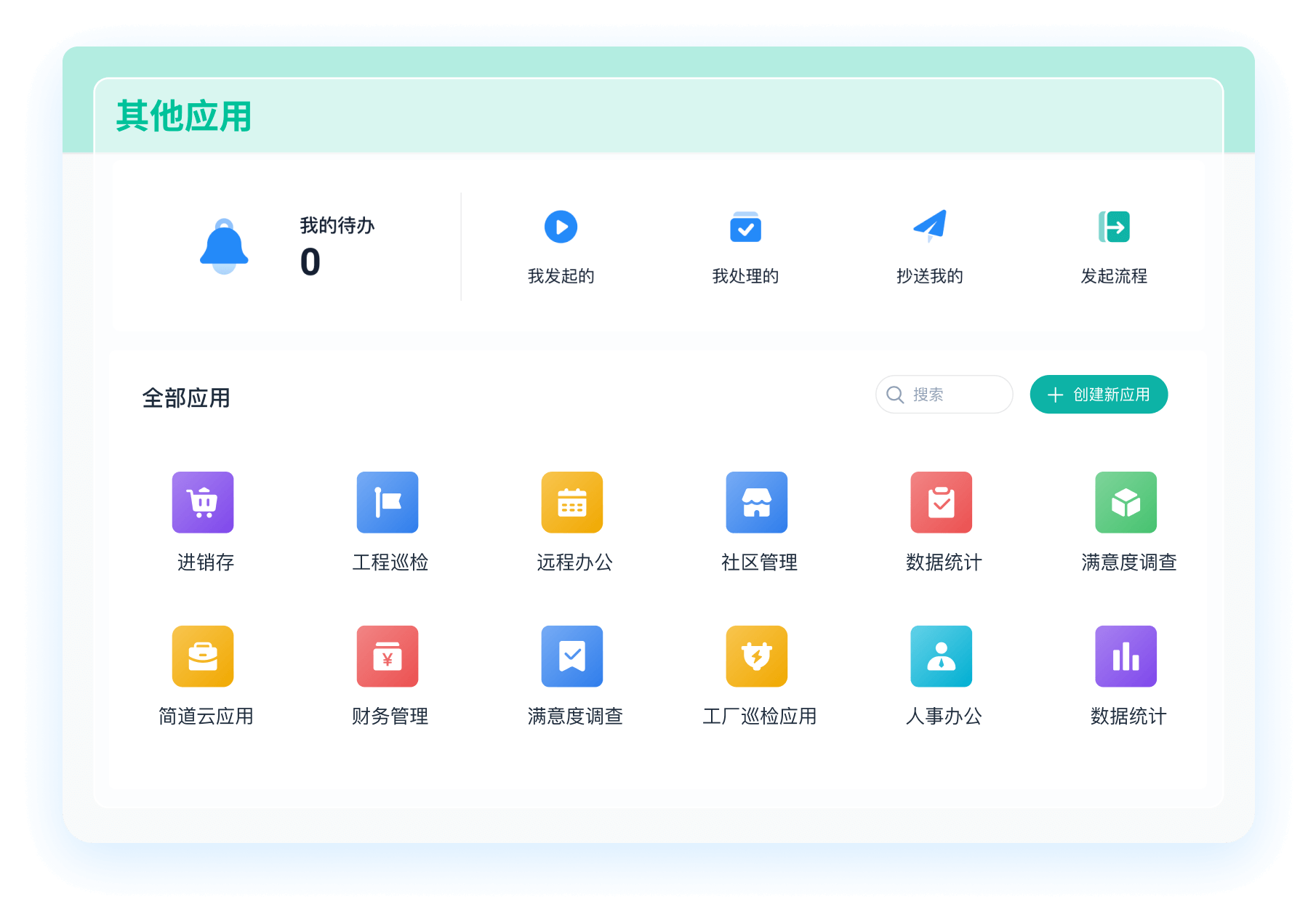

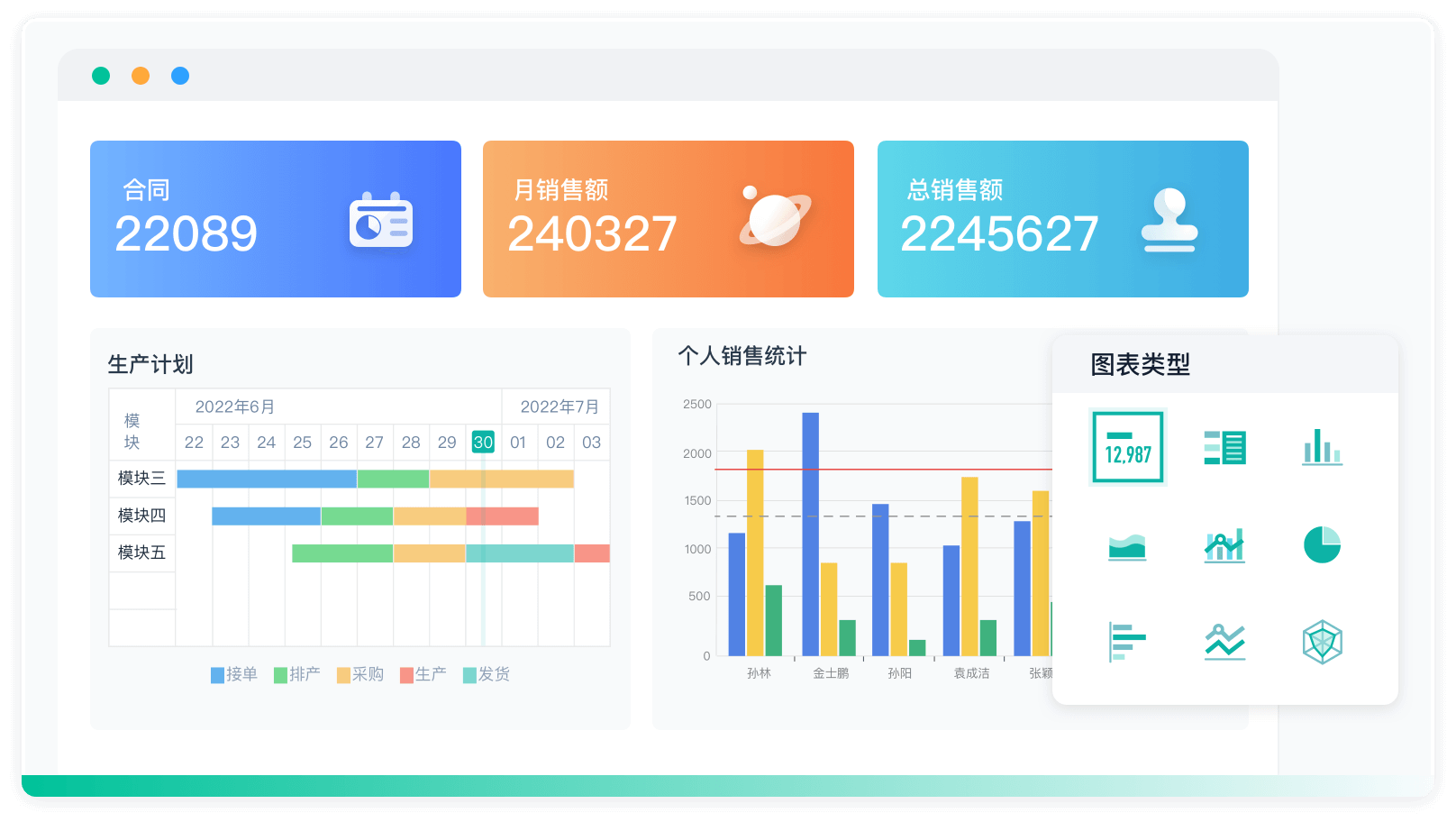

简道云财务管理模板: https://s.fanruan.com/a2orj;

无需下载,在线即可使用。

阅读时间:5 分钟

阅读时间:5 分钟  浏览量:5779次

浏览量:5779次

《零代码开发知识图谱》

《零代码开发知识图谱》

《零代码

新动能》案例集

《零代码

新动能》案例集

《企业零代码系统搭建指南》

《企业零代码系统搭建指南》