Several popular English-language financial software options include: 1) QuickBooks, 2) Xero, 3) FreshBooks, 4) Wave, and 5) Sage Intacct. These platforms cater to different business needs, from small startups to large enterprises, offering features such as invoicing, expense tracking, payroll processing, and advanced financial reporting. Let's delve into the specifics of each to help you make an informed decision.

I、QUICKBOOKS

QuickBooks is one of the most widely used financial software solutions globally. It is particularly popular among small to medium-sized businesses due to its user-friendly interface and comprehensive features.

Key Features:

- Invoicing: Create and send professional invoices.

- Expense Tracking: Track expenses and categorize them for tax purposes.

- Payroll Processing: Manage employee salaries, benefits, and tax withholdings.

- Financial Reporting: Generate detailed financial reports such as profit and loss statements and balance sheets.

Benefits:

- Ease of Use: Intuitive design that is easy to navigate.

- Scalability: Suitable for both small businesses and growing enterprises.

- Integration: Works seamlessly with other software like PayPal, Shopify, and more.

Limitations:

- Cost: Subscription can be expensive for some businesses.

- Complexity: Advanced features may require a learning curve.

Use Case:

A small retail business uses QuickBooks to manage daily transactions, track inventory, and generate monthly financial reports, facilitating better financial planning and decision-making.

II、XERO

Xero is another robust financial management software designed for small to medium-sized businesses. It is known for its cloud-based capabilities and real-time financial data access.

Key Features:

- Bank Reconciliation: Automatically import and categorize bank transactions.

- Inventory Management: Track inventory levels and manage orders.

- Multi-currency: Handle transactions in multiple currencies.

- Collaboration: Allow multiple users to access and work on financial data simultaneously.

Benefits:

- Cloud-Based: Access your data from anywhere, anytime.

- User-Friendly: Simple and clean interface.

- Extensive Integrations: Over 800 third-party apps available for integration.

Limitations:

- Price: Higher cost compared to some competitors.

- Limited Payroll Features: Payroll functionality is limited in some regions.

Use Case:

A marketing agency uses Xero to manage client billing, monitor project expenses, and maintain up-to-date financial records accessible to all team members.

III、FRESHBOOKS

FreshBooks is a cloud-based accounting software tailored for freelancers and small business owners. It focuses on simplifying invoicing, time tracking, and expense management.

Key Features:

- Invoicing: Customizable and automated invoicing.

- Time Tracking: Track billable hours and link them to projects.

- Expense Management: Snap photos of receipts and track expenses on the go.

- Client Portal: Provide clients with access to their invoices and project status.

Benefits:

- Easy Setup: Quick and straightforward to get started.

- Mobile App: Manage finances from your smartphone.

- Customer Support: Excellent customer service and support.

Limitations:

- Limited Features: Not as feature-rich as some competitors.

- Pricing: Can be costly for businesses with multiple users.

Use Case:

A freelance graphic designer uses FreshBooks to send invoices, track project time, and manage expenses, ensuring timely payments and organized financial records.

IV、WAVE

Wave is a free financial software solution that offers essential accounting features for small businesses. It is particularly appealing to startups and businesses with tight budgets.

Key Features:

- Invoicing: Create, send, and track professional invoices.

- Accounting: Manage income, expenses, and transactions.

- Receipts: Scan and digitize receipts.

- Payroll: Simplified payroll processing (additional cost).

Benefits:

- Free: No cost for basic accounting and invoicing features.

- Simple Interface: User-friendly and easy to navigate.

- No Hidden Fees: Transparent pricing for additional services.

Limitations:

- Limited Features: Fewer advanced features compared to paid software.

- Customer Support: Limited support options.

Use Case:

A small e-commerce store uses Wave to manage sales, track expenses, and handle basic accounting tasks without incurring additional costs.

V、SAGE INTACCT

Sage Intacct is an advanced financial management software designed for growing businesses and enterprises. It offers a wide range of features to handle complex financial needs.

Key Features:

- Core Financials: General ledger, accounts payable, accounts receivable.

- Order Management: Streamlined order processing and inventory management.

- Dashboards and Reporting: Real-time financial insights and customizable dashboards.

- Multi-Entity Management: Manage finances for multiple entities or locations.

Benefits:

- Scalability: Suitable for growing businesses with complex financial needs.

- Customization: Highly customizable to fit specific business requirements.

- Integration: Integrates with various ERP, CRM, and other business systems.

Limitations:

- Cost: Higher price point, suitable for larger businesses.

- Implementation: Longer implementation time compared to simpler solutions.

Use Case:

A mid-sized manufacturing company uses Sage Intacct to manage its finances across multiple locations, track inventory, and generate detailed financial reports for strategic planning.

SUMMARY AND RECOMMENDATIONS

In summary, choosing the right financial software depends on your business size, specific needs, and budget:

- QuickBooks is ideal for small to medium-sized businesses looking for comprehensive features and scalability.

- Xero is excellent for businesses needing robust cloud-based solutions with extensive integrations.

- FreshBooks suits freelancers and small business owners who prioritize invoicing and time tracking.

- Wave is perfect for startups and small businesses seeking a free, basic accounting solution.

- Sage Intacct is best for growing enterprises with complex financial requirements and multiple entities.

Further Recommendations:

- Assess Your Needs: Determine the specific features you need, such as invoicing, payroll, or multi-currency support.

- Consider Budget: Evaluate the cost and ensure it aligns with your financial capacity.

- Trial Periods: Take advantage of free trials to test the software before committing.

- Consult Reviews: Read user reviews and case studies to understand real-world experiences.

- Seek Expert Advice: Consult with a financial advisor or software consultant to make the best choice for your business.

By carefully considering these factors, you can select a financial software solution that will enhance your business operations and support your financial management needs.

相关问答FAQs:

在全球化的商业环境中,选择合适的财务软件对于企业的管理和运营至关重要。以下是一些知名的全英文财务软件,它们在功能、用户友好性和支持服务方面都表现出色。

1. What are some of the top English financial software options available?

There are numerous financial software solutions available in English, catering to various business needs. Some of the most popular options include:

-

QuickBooks: This is one of the most widely used financial management software, especially among small to medium-sized businesses. QuickBooks offers features such as invoicing, expense tracking, and payroll processing. Its user-friendly interface and extensive reporting capabilities make it a favorite for many entrepreneurs.

-

Xero: Xero is a cloud-based accounting software that is particularly popular among small businesses. It provides real-time financial data, allowing users to manage invoices, bank transactions, and inventory seamlessly. Xero also integrates well with numerous third-party applications, enhancing its functionality.

-

FreshBooks: Designed primarily for service-based businesses, FreshBooks excels in invoicing and time tracking. It provides an intuitive interface that allows users to create professional invoices, manage expenses, and track project time effortlessly.

-

Sage Intacct: This is a robust cloud financial management solution that caters to medium to large businesses. Sage Intacct offers advanced features such as multi-entity management, real-time financial reporting, and compliance management, making it suitable for businesses with complex financial requirements.

-

Wave Accounting: Wave is a free accounting software that is ideal for freelancers and small businesses. It offers basic features such as income and expense tracking, invoicing, and receipt scanning, making it a great choice for those just starting out.

-

Zoho Books: Part of the Zoho suite, Zoho Books offers a comprehensive accounting solution that includes features like invoicing, expense tracking, and inventory management. Its user-friendly interface and automation features make it a popular choice among small businesses.

-

NetSuite: This is a more advanced financial management software designed for larger enterprises. NetSuite provides a comprehensive suite of applications, including ERP, CRM, and eCommerce capabilities, making it suitable for businesses looking for an all-in-one solution.

Each of these software options has its unique strengths and caters to different business needs, allowing users to choose the one that best fits their requirements.

2. How do I choose the right financial software for my business?

Selecting the right financial software can be a daunting task, given the multitude of options available. Here are several key considerations to keep in mind:

-

Identify Your Needs: Start by outlining the specific financial functions your business requires. For instance, do you need invoicing capabilities, expense tracking, payroll management, or comprehensive financial reporting? Understanding your core needs will help narrow down your choices.

-

Scalability: Consider whether the software can grow with your business. If you anticipate expansion, it’s essential to choose a solution that can accommodate increased transactions, users, and functionalities without requiring a complete overhaul.

-

User-Friendliness: The software should have an intuitive interface that is easy for you and your team to navigate. A steep learning curve can lead to frustration and inefficiencies.

-

Integration Capabilities: Ensure that the financial software can integrate with other tools and applications your business uses, such as CRM systems, payment processors, and eCommerce platforms. This will streamline operations and improve data accuracy.

-

Support and Training: Evaluate the level of customer support and training resources offered by the software provider. Having access to responsive support and comprehensive training can significantly impact your experience with the software.

-

Cost: Consider your budget and the pricing structure of the software. Many options offer monthly or annual subscriptions, while others may have one-time licensing fees. Be sure to weigh the costs against the features offered.

-

Reviews and Recommendations: Research user reviews and seek recommendations from fellow business owners or financial professionals. Their insights can provide valuable information about the software’s performance and reliability.

Taking the time to assess these factors will help you make an informed decision and choose the financial software that best aligns with your business goals.

3. What are the benefits of using English financial software?

Utilizing English financial software provides a range of advantages that can enhance your business operations:

-

Accessibility: English is widely spoken and understood globally, making it easier to find resources, support, and training materials. This accessibility facilitates smoother onboarding for users and helps in troubleshooting issues that may arise.

-

Integration with Global Standards: Many businesses operate internationally, and using English financial software can align your financial processes with global standards. This is particularly important for compliance with international accounting principles and regulations.

-

Collaboration Opportunities: If your team is diverse or if you work with international clients and partners, English financial software promotes better collaboration. Stakeholders from different regions can easily access and understand financial data, improving communication and decision-making.

-

Regular Updates and Features: Leading financial software providers often prioritize English versions, ensuring that they receive regular updates, new features, and security enhancements. Staying current with software developments can enhance your business's operational efficiency.

-

Extensive Community and Resources: English financial software typically has a larger user base, leading to a wealth of online forums, tutorials, and resources. This community support can be invaluable when seeking solutions to specific challenges or when looking for tips to maximize software usage.

Adopting English financial software can significantly streamline your business processes, enhance collaboration, and ensure compliance with global standards.

In conclusion, selecting the right financial software is crucial for effective business management. With numerous options available, it’s important to assess your specific needs, consider scalability and user-friendliness, and evaluate integration capabilities. The benefits of using English financial software further enhance its appeal, making it a wise choice for businesses operating in today's global economy.

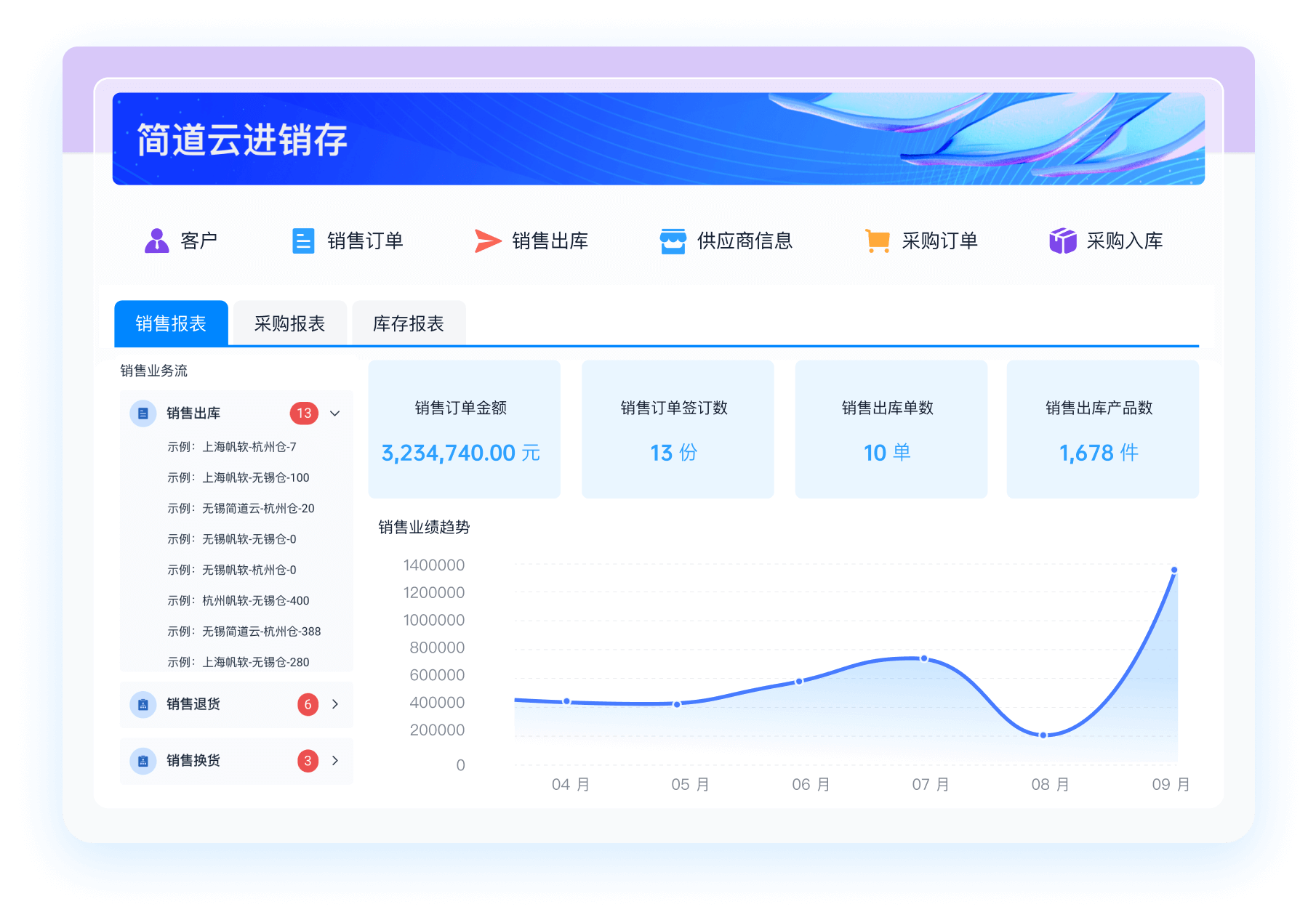

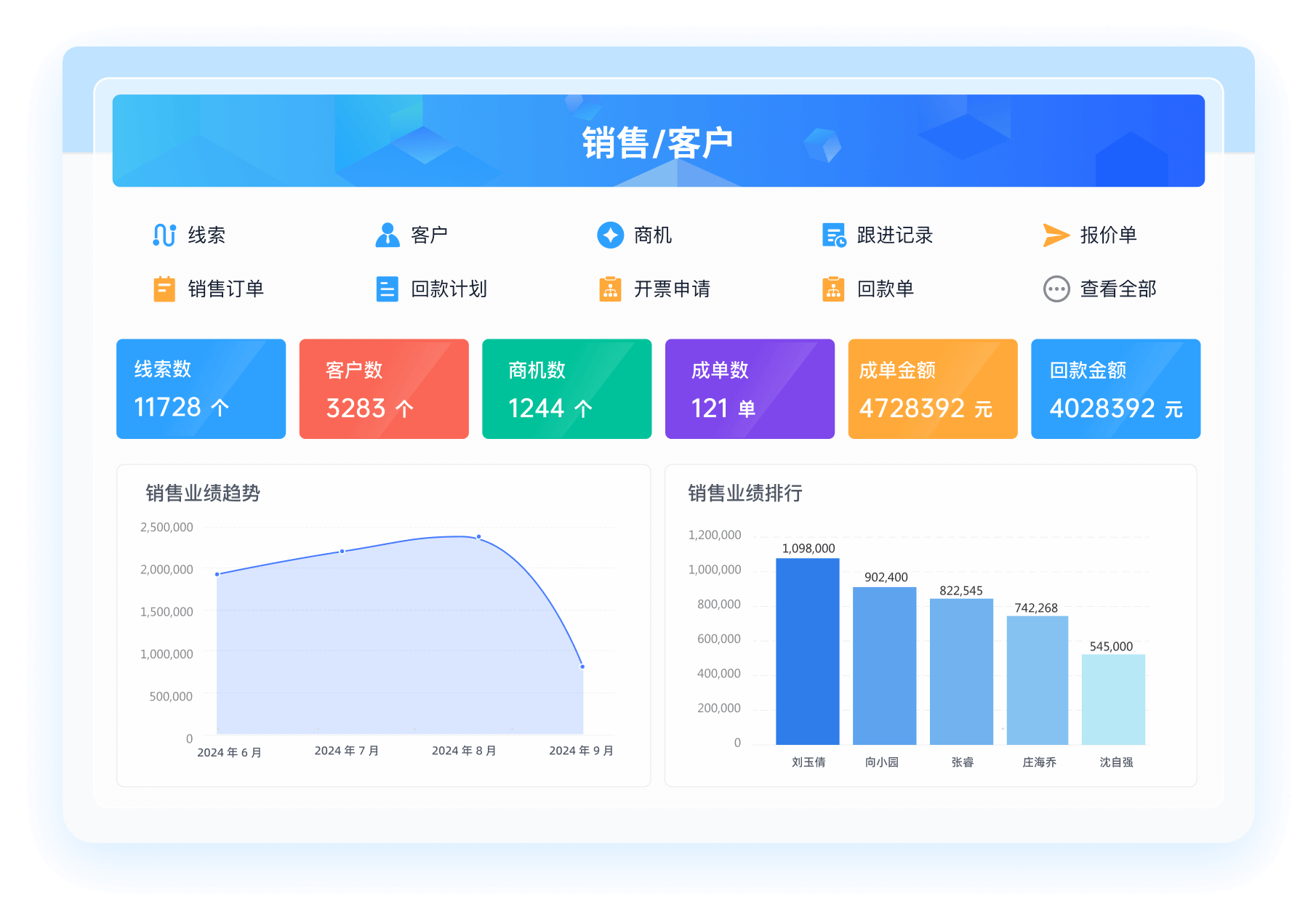

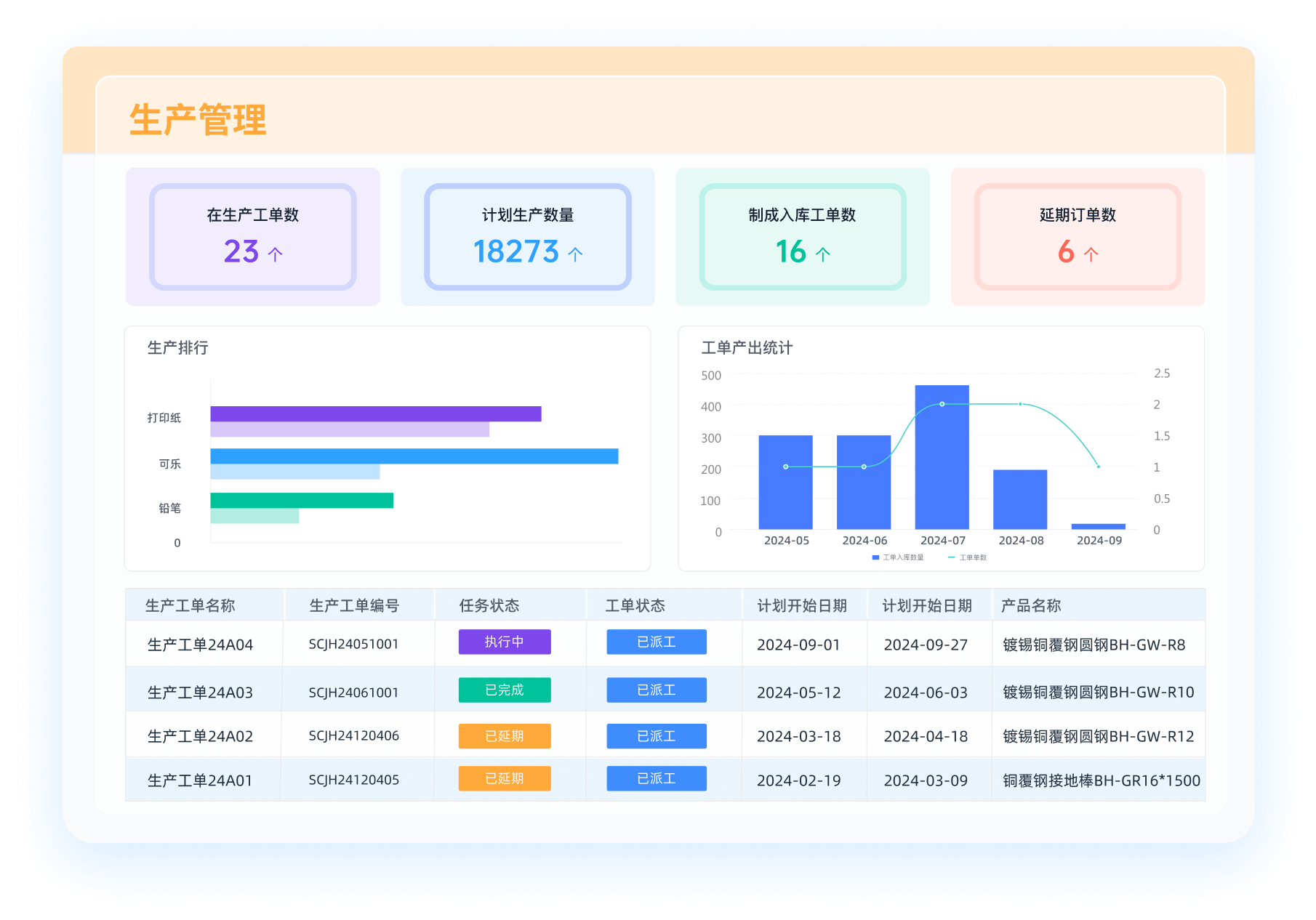

简道云财务管理模板: https://s.fanruan.com/a2orj;

无需下载,在线即可使用

阅读时间:8 分钟

阅读时间:8 分钟  浏览量:8093次

浏览量:8093次

《零代码开发知识图谱》

《零代码开发知识图谱》

《零代码

新动能》案例集

《零代码

新动能》案例集

《企业零代码系统搭建指南》

《企业零代码系统搭建指南》